Your support is critical in helping us achieve our mission of protecting and educating 250,000 students across New York City. With identity theft and financial challenges becoming more common, young people need the tools to safeguard their personal information and build a strong financial foundation. By donating to The R.A.R.E. Foundation, you’re not just providing immediate protection against cyber threats; you’re equipping students with life-changing financial literacy education that will empower them for years to come. Your contribution helps break the cycle of financial instability, ensures students are prepared for the future, and fosters a generation that understands the value of financial responsibility.

At The R.A.R.E. Foundation, we believe that everyone deserves the opportunity to achieve economic prosperity, regardless of their background or circumstances. Our mission is to empower underserved communities that face significant financial struggles with few resources and limited access to education. Without intervention, many of these individuals will find it nearly impossible to break the cycle of poverty and build a better future for themselves and their families.

We believe that understanding credit is fundamental to financial empowerment. Our programs teach individuals how to manage, build, and repair their credit, giving them the tools they need to secure loans, housing, and other essential services. Credit education is the cornerstone of financial recovery, and it is where we begin our journey with every individual we help.

We are deeply committed to making our services accessible to those who need them most. We bring our programs directly into communities, ensuring that everyone, regardless of their location or circumstances, has the opportunity to participate. By embedding ourselves within communities, we can better understand their unique challenges and tailor our services to meet their specific needs.

We believe that understanding credit is fundamental to financial empowerment. Our programs teach individuals how to manage, build, and repair their credit, giving them the tools they need to secure loans, housing, and other essential services. Credit education is the cornerstone of financial recovery, and it is where we begin our journey with every individual we help.

We know that we cannot do this alone. That’s why we forge strategic partnerships with organizations, businesses, and community leaders who share our vision. These alliances allow us to extend our reach, amplify our impact, and offer a more comprehensive suite of services to those in need.

Your donation is more than a contribution—it’s an investment in the future of our communities. Act today and help us make a difference.

Thank you for your generosity and support

The R.A.R.E. Foundation was born out of a deep desire to create a nation where every individual, regardless of their background, has the opportunity to achieve financial prosperity. Founded in January 2016 by a small group of passionate New York residents, our vision was simple yet profound: to ensure that all segments of our community are provided with the tools and resources they need to thrive.

From the very beginning, we knew that financial education was key to breaking the cycle of poverty and creating lasting change. Our founders recognized the urgent need for Credit Literacy & Recovery, Entrepreneur Services, and Job Preparation in underserved communities. With a clear mission and unwavering commitment, The R.A.R.E. Foundation set out to make a difference.

In just a few short years, our efforts have touched the lives of hundreds of individuals. We've provided expert credit education, helping people understand, manage, and rebuild their credit. We've supported aspiring entrepreneurs, giving them the knowledge and resources they need to start and grow their businesses. And we've helped countless individuals prepare for the job market, equipping them with the skills and confidence to succeed.

Our impact has been particularly felt among veterans and the formerly incarcerated—two groups that often face significant barriers to financial stability. Veterans have been served with the respect and support they deserve, ensuring they can access the benefits and opportunities they've earned. The formerly incarcerated have been given a second chance at life, with access to the tools and education they need for full recovery and reintegration into society.

The R.A.R.E. Foundation is dedicated to providing essential financial recovery education and training to underserved communities. Together we restore communities one credit profile at a time.

The Platinum Package is designed for organizations, businesses, and communities committed to making a lasting impact by safeguarding the financial futures of their members and students. With this package, you can protect 100 students from a school while also offering essential financial literacy and identity protection services to your employees or group members.

Now more than ever, organizations have a duty to support their communities and promote financial well-being. By choosing the Platinum Package, your organization demonstrates its commitment to Social Responsibility—helping not only your employees but also protecting the next generation of students. Together, we can create a ripple effect of financial empowerment, benefiting both your organization and the wider community.

The Gold Package offers comprehensive financial protection and education for you as well as 6 sponsored students. This premium package equips you with the resources to secure your financial future while making a significant impact by helping multiple students gain critical financial literacy skills and identity protection.

With the Silver Package, you’ll gain enhanced financial protection and education for both you and a sponsored student. For just $50, you’ll receive a powerful set of tools designed to secure your financial future and make a meaningful impact by sponsoring 2 students. Here’s what’s included:

When you donate through the Bronze Package, you’ll receive essential tools to empower your financial journey, while also making a lasting impact by providing the same resources to a student in need. With your donation, both you and a sponsored student will benefit from the following:

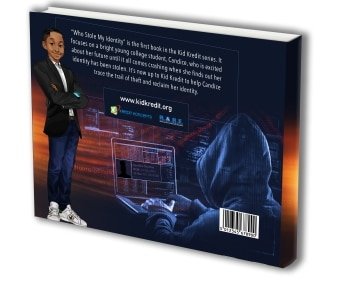

"Who Stole My Identity?" by Kid Kredit is an engaging and informative e-book that covers: