Your Donations Restore Communities

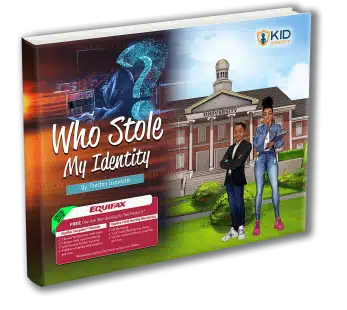

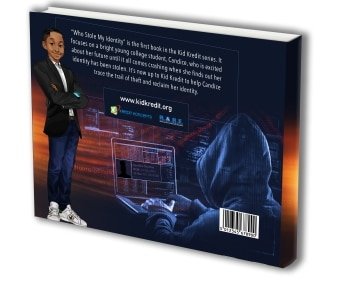

Rebuilding Lives Through Financial Recovery and Identity Protection

The R.A.R.E. Foundation is dedicated to providing essential financial recovery education and training to underserved communities. Together we restore communities one credit profile at a time.

0

+

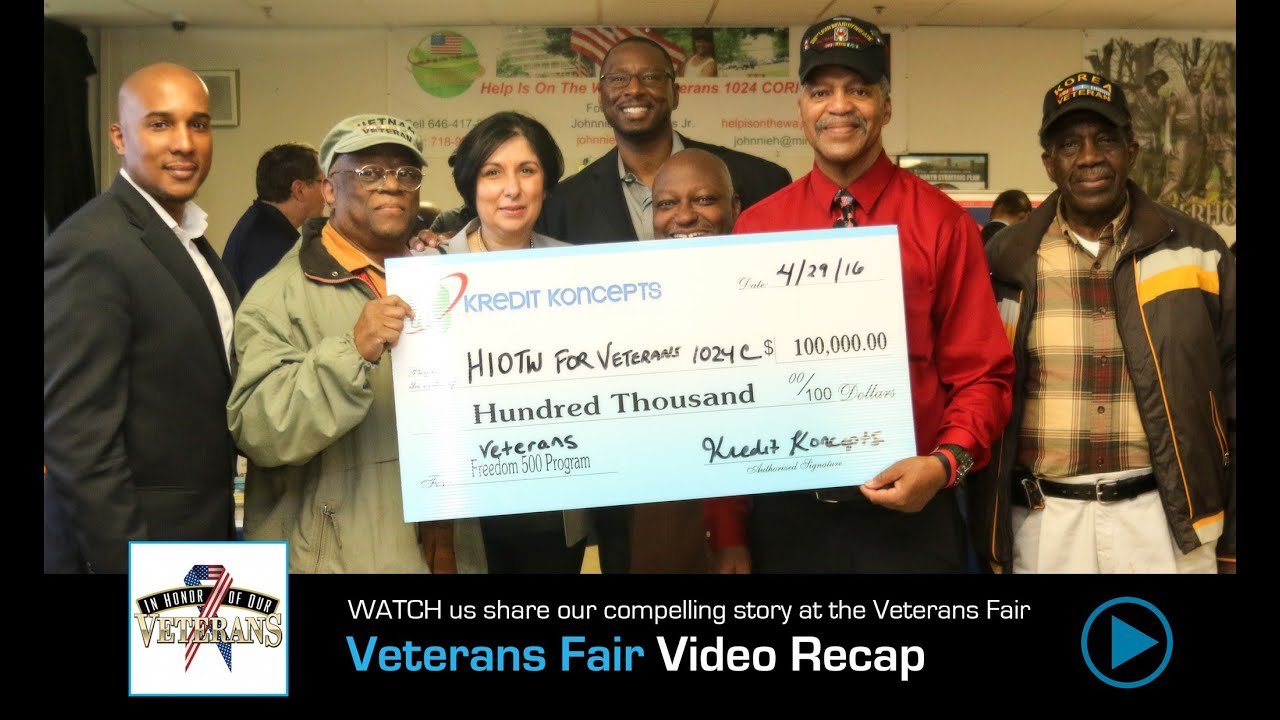

Veterans, Returning Citizens, and School Students Recovered and Protected.